Public Governance

Projects pertaining to a range of different ministerial department transgressions and issues which require challenging

OUTA’s Public Governance Portfolio was established to focus on challenging unfair government policy across a range of ministerial departments.

In this portfolio we have undertaken the following projects:

Oversight of Parliament

OUTA's reports find that Parliament has consistently failed to defend South Africa against state capture and looting. OUTA submitted information on this to the State Capture Commission and to Parliament, and has published seven annual reports on oversight of Parliament. Our latest report, which finds hope for an improved Parliament, was published in October 2025.

Tips For Members of Parliament

OUTA has written “Tips for Members of Parliament to aid in more effective & improved oversight duties”, which encourages MPs to provide ethical leadership and use their positions in Parliament to combat corruption and ensure good governance.

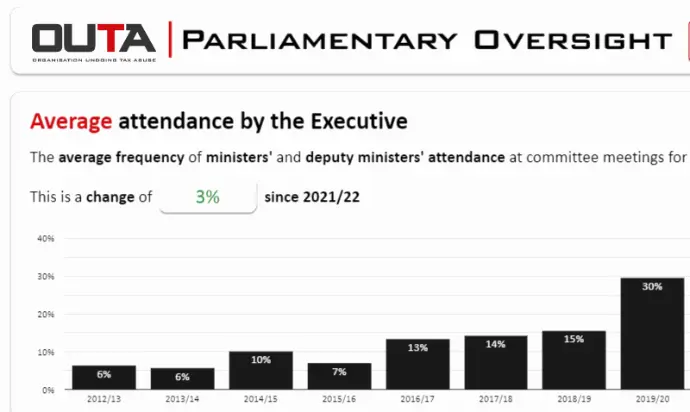

OUTA's Oversight Dashboard

OUTA has developed a parliamentary oversight dashboard, to provide a quick look at the quantitative data in our annual parliamentary oversight reports.

Parliamentary Oversight Dashboard co-funded by the European Union

In 2023 OUTA partnered with the Parliamentary Monitoring Group (PMG) and OpenUp to propose the development of a Parliamentary Oversight Dashboard. This project is co-funded by the European Union under their Enhancing Accountability Programme. The dashboard project aims to create a user-friendly, open-source platform for monitoring and assessing parliamentary performance.

#BeTheBoss

Imagine having more control over who is in government. Imagine being able to choose people you know and trust to get the work done an build a better South Africa for all.

#BeTheBoss. Register to vote. Vote. Be the change.

Electoral Reform: from Concourt to Parliament

We'd like an electoral system that strengthens the voters' ability to hold politicians to account.

We started in the Constitutional Court in July 2019 and, by 2022, OUTA was making submissions to Parliament on the resulting Electoral Amendment Bill.

Budget 2021

OUTA has made submissions to Parliament on Budget 2021 and the Medium-Term Budget Policy Statement 2021.

Budget 2022

The Medium-Term Budget Policy Statement 2022 announced the end of the e-tolls scheme, but did not finalise paying off the Gauteng Freeway Improvement Project debt. OUTA made a submission on this.

Getting the right commissioners for the Commission on Gender Equality

During 2022, Parliament's Portfolio Committee on Women, Youth and Persons with Disabilities called for nominations and applications for positions of commissioners on the Commission for Gender Equality. OUTA believes the process was inadequate and did not ensure the best candidates were appointed.

Budget 2020 & Supplementary Budget

Budget 2020 is being rewritten because of economic fallout from Covid-19. OUTA has made submissions to Parliament to support this process.

Budget 2023

Budget 2023 was loaded with costs from the state capture years: bailouts for Eskom, SAA and the Post Office, but extra money for political parties.

Previous Projects

Taxation Submission 2018

The South African tax base is extremely small (estimated at 13% of the overall population) and a situation of over taxation has now been reached. This has the impact of tax flight and a reverse effect in collection rates.

Watching the State of the Nation Addresses (SONAs)

Every year Parliament opens with the President's State of the Nation Address. Every year there are promises, which are often repeated and not kept.